5 Common Financial Mistakes Small Businesses Make (and How to Fix Them with a Spreadsheet)

Starting a small business is a dream come true for many. The passion, the independence, and the joy of seeing your vision come to life are incredibly rewarding. However, even the most passionate entrepreneurs can stumble when it comes to managing their finances. Ignoring essential financial practices can quickly turn a promising venture into a stressful burden.

The good news? Most common financial pitfalls are entirely avoidable with the right tools and habits. You don’t need a finance degree to keep your books in order. Often, a well-designed spreadsheet is all you need to track, plan, and protect your business’s financial health.

Let’s dive into the five most common financial mistakes small businesses make and explore how simple, effective spreadsheet solutions can help you fix them. `

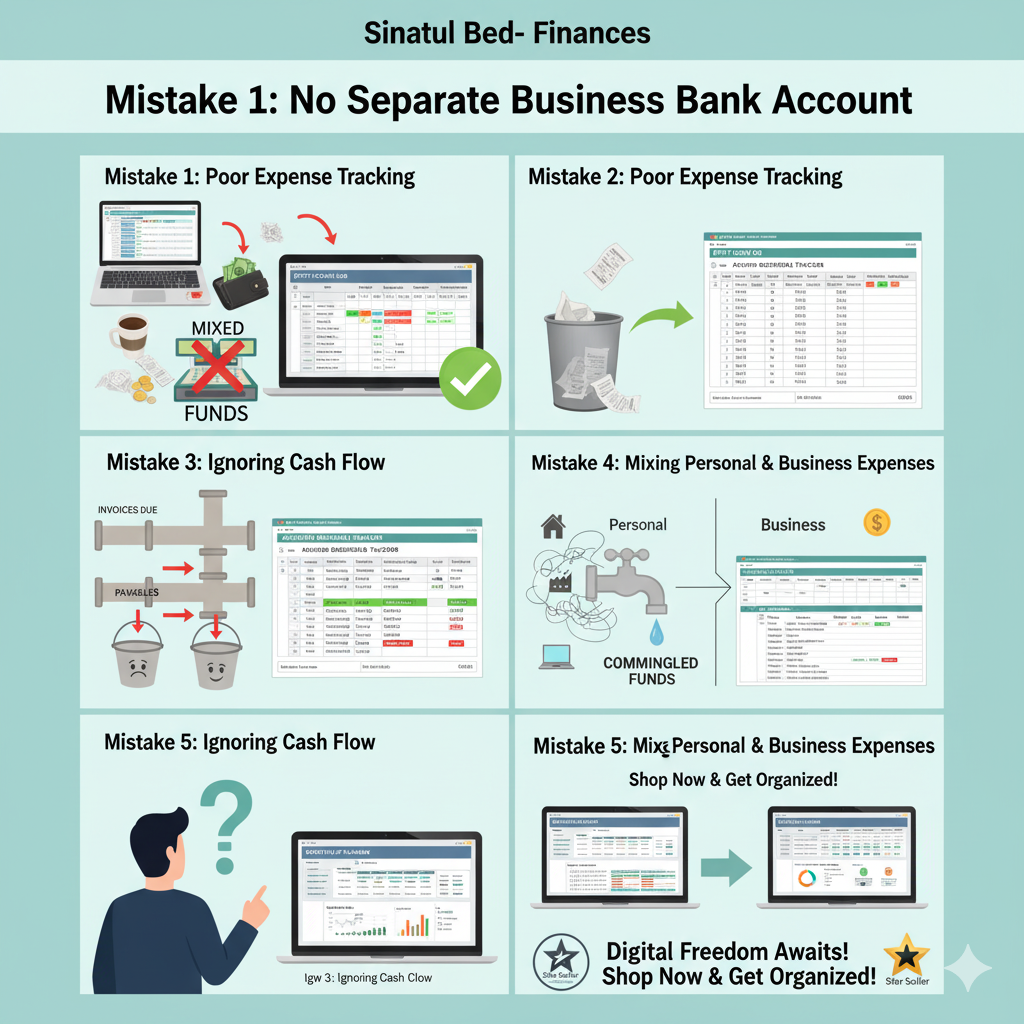

Mistake 1: Not Separating Personal and Business Finances

This is perhaps the most common and dangerous mistake for new business owners. When you mix your personal bank account with your business transactions, it creates a muddy picture of your financial health. You can’t truly know if your business is profitable if you’re paying your personal grocery bills from the same account that receives client payments. This also makes tax time a nightmare and can even jeopardize your legal protection as a business entity.

The Fix: Open a separate bank account specifically for your business. Every single business transaction—income and expense—should go through this account. For tracking daily, small cash outflows, avoid dipping into your main business account for petty expenses. `

Spreadsheet Solution: The Petty Cash Log

For those small, everyday cash expenses (office supplies, minor travel, coffee for clients), a dedicated Petty Cash Log is essential. It ensures every penny is accounted for, providing a clear record of where your cash goes without mixing it with your main business ledger.

-> Get Our Petty Cash Log Template on Etsy to track every small expense.

Mistake 2: Poor Expense Tracking

Many small business owners only look at their bank balance to gauge success. But a healthy bank balance doesn’t tell you the story of where your money is going or how efficiently you’re spending it. Neglecting to track expenses meticulously means you could be missing out on valuable tax deductions, overspending in certain areas, and lacking clear data for future budgeting decisions. This leads to unexpected cash flow problems and missed opportunities for growth.

The Fix: Implement a rigorous system for recording every single expense, no matter how small. Categorize your expenses as they occur. This seems tedious, but it saves hours (and money!) later. `

Spreadsheet Solution: General Ledger & Expense Tracker

A General Ledger is the backbone of proper bookkeeping. It allows you to record every financial transaction, categorizing them into accounts like income, expenses, assets, and liabilities. This provides a holistic view of your financial standing and ensures you’re ready for tax season. For simpler expense tracking, a dedicated Expense Tracker can help you monitor spending across different categories.

-> Organize all your finances with our General Ledger Template on Etsy.

-> Or, simplify expense tracking with our dedicated Expense Tracker.

Mistake 3: Ignoring Cash Flow

“Cash flow is king” is a common saying for a reason. You can have a thriving business with lots of sales, but if you don’t have enough liquid cash to cover your immediate expenses (payroll, rent, supplier payments), your business can quickly grind to a halt. Ignoring when money comes in and when it goes out is a recipe for disaster, leading to bounced checks, late payments, and a damaged reputation. This mistake often stems from a lack of forecasting and active monitoring of payables and receivables.

The Fix: Create a simple cash flow projection. Understand your typical payment cycles and payment terms from clients and suppliers. Actively monitor your accounts receivable (money owed to you) and accounts payable (money you owe). `

Spreadsheet Solution: Cash Flow Forecast & Accounts Receivable Tracker

A Cash Flow Forecast spreadsheet helps you predict your cash inflows and outflows over a specific period, allowing you to anticipate potential shortfalls. Alongside this, an Accounts Receivable Tracker ensures you know exactly who owes you money, how much, and when it’s due, helping you follow up promptly and maintain a healthy cash flow.

-> Master your cash flow with our Cash Flow Forecast Template on Etsy.

-> Don’t let invoices fall through the cracks! Get our Accounts Receivable Tracker.

Mistake 4: Not Budgeting (or Sticking to One)

A budget isn’t just for individuals; it’s a vital roadmap for your business. Without a budget, you’re essentially driving blind, with no clear idea of how much you can afford to spend, where you can cut costs, or what your profit margins truly are. Many businesses make the mistake of creating a budget but then failing to review it regularly or adjust it as circumstances change. This leads to overspending, missed financial goals, and an inability to adapt to market fluctuations.

The Fix: Develop a realistic budget for different timeframes (monthly, quarterly, annually). Regularly compare your actual spending against your budgeted amounts and make necessary adjustments. `

Spreadsheet Solution: Monthly or Annual Budget Planners

Our Monthly Budget Planner and Annual Budget Template provide clear frameworks to allocate your resources effectively. They help you set financial goals, track your progress, and identify areas for improvement, ensuring your spending aligns with your business objectives.

-> Start budgeting smart today with our Monthly Budget Planner on Etsy.

-> For long-term vision, use our Annual Budget Template.

Mistake 5: Neglecting to Review Financial Performance

Finally, many business owners are so busy doing the work that they forget to review the results. Simply tracking transactions isn’t enough; you need to analyze your financial reports regularly. Are your sales increasing? Are your expenses staying within budget? What are your most profitable products or services? Ignoring these insights means you’re missing opportunities to grow, optimize, and make informed strategic decisions.

The Fix: Set aside dedicated time each month or quarter to review your profit and loss statements, balance sheets, and cash flow reports. Understand what the numbers are telling you about your business’s health. `

Spreadsheet Solution: Profit and Loss Statement (P&L)

A Profit and Loss (P&L) Statement (also known as an Income Statement) summarizes your revenues, costs, and expenses over a period. It’s the ultimate report for understanding your business’s profitability. Regularly reviewing your P&L helps you identify trends, make pricing adjustments, and cut unnecessary costs.

-> Gain clear insights into your profitability with our P&L Statement Template.

Conclusion: Running a small business is challenging, but managing its finances doesn’t have to be. By recognizing these common mistakes and implementing simple, effective spreadsheet solutions, you can gain control of your financial health, make smarter decisions, and pave the way for sustainable growth. Don’t let financial missteps hold you back – empower your business with organized, clear, and actionable financial data today!

Leave a Reply